As it is, you have to first figure out how much you’ve spent before you can figure out a realistic budget for a given category.

QUICKEN FOR MAC VS IBANK SOFTWARE

So, for example, if iBank already knows that I’ve spent an average of $100 per month over the last three months for groceries, the budget for the groceries category should already have $100 in the budget amount field. IBank 4 is the leading personal finance software for OS X.

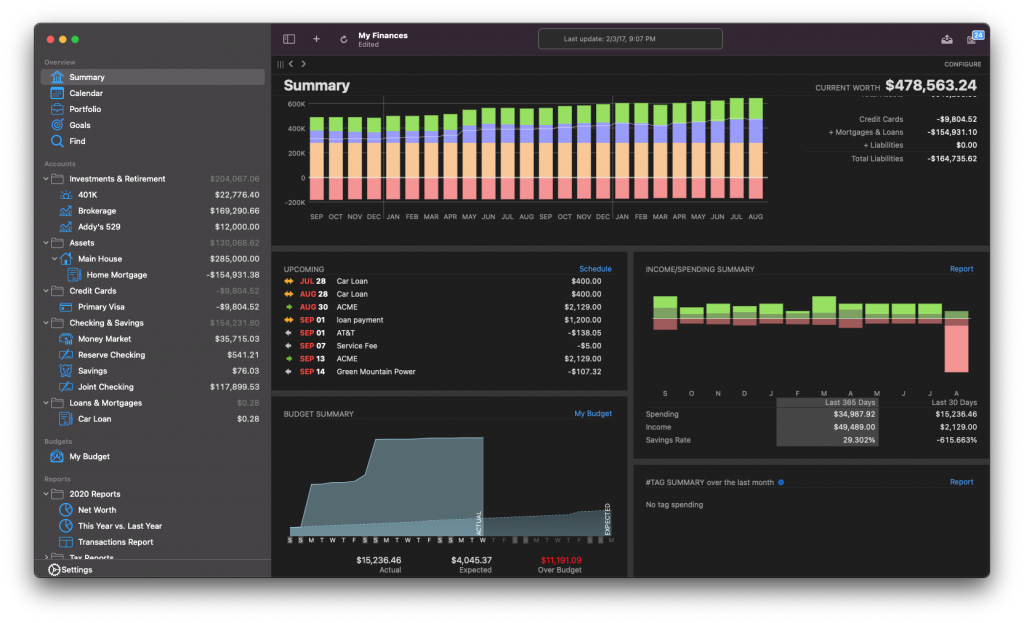

Since Quicken and just about any other finance program that I can think of. IGG’s mission has always been to simplify the. Currently, Banktivity 5 is available for purchase and download, and Banktivity 6 will be released in Spring 2017. Gillespie and created by IGG software, iBank is now known as Banktivity. The key to exporting your data is always use the 'Export to QIF' option. Before iBank, there was no comprehensive, full-featured budget software for Mac users. I use the very handy 'CheckBook' for Mac and my MS Money files exported to that program as well.

I recommended that previous Quicken users go. The answer is YES you can export MS Money files to Quicken Mac, iBank, and many other Mac programs. Finally, I had a decision to make: Quicken Essentials or iBank 3 You can read my conclusion in the article Quicken Essentials for Mac The Bare Minimum. I wrote a review of iBank 3: iBank Your Quicken Alternative.

QUICKEN FOR MAC VS IBANK TRIAL

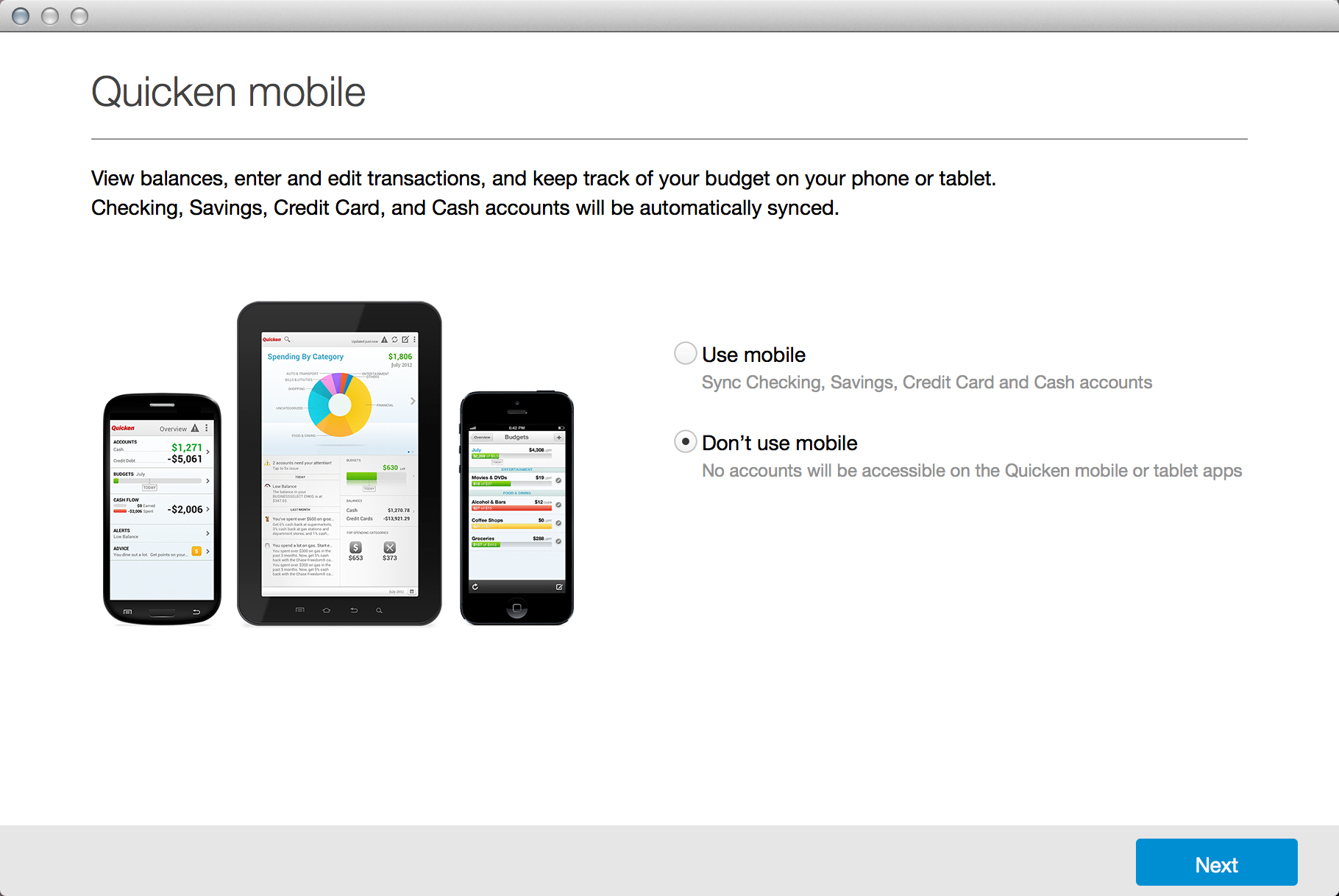

In future versions of the tool, however, I’d like to see some way to take the expense information I’ve already collected for a specific category and use that as a starting point for a specific budget item. Moneydance vs ibank moneydance 2015 moneydance for mac reviews moneydance trial moneydance vs quicken 2015 moneydance help moneydance tutorial moneydance coupon Keep track of your finances with online banking, bill payment, budgeting, and investment tracking. I was looking for alternatives to Quicken, and iBank seemed like a good choice. IBank for iPad offers a very effective budgeting tool you can use to create budgets for any of the categories you’ve created you can then use those budgets to track your income and expenses.

In practice, though, I found that when I used Direct Access, I didn’t need to use the tools-iBank for iPad almost always categorized my transactions correctly. Double-tapping any transaction reveals a small menu offering options to edit, categorize, or delete a transaction. Whether you download the transactions directly or enter them yourself, editing and categorizing your transactions is a snap. Not only can you connect to and download transactions from such banks as Wells Fargo and Chase, but you can also connect to obscure banks such as the teacher’s credit union my wife belongs to. Bought this for Mac based on reviews, once Quicken basically abandoned the Mac. To my surprise and pleasure, iBank’s Direct Access service is not limited to a selection of well-known banks, which has been the case with every other service of that type that I’ve tried.

0 kommentar(er)

0 kommentar(er)